WallStreetBets: The unexpected origin of a retail investing boom

When we think of the stock market, you may think of men in suits yelling on the trading floor on Wall Street in New York. Or, more accurately, you think of large investment firms using state-of-the-art technology to move massive amounts of money around to make a seemingly small margin on a stock and overtime, amassing massive amounts of capital. One thing you do not think of is Reddit users. However, over the past two years, the Reddit community/wallstreetbets has grown to over 9.4 million members and gained widespread popularity for its place in the classic underdog story.

A couple of years ago, I found myself perusing the Reddit community. After being gifted money for Christmas to start investing, I had grown tired of making a marginal profit. I read a few posts about the chipmaker AMD and decided to invest. After a couple of weeks, I had just managed to break even and I was hankering for more.

At this point, I was introduced to the world of options trading. An option is a contract that one can purchase giving them the ability to buy 100 shares of a stock at a certain price in the future. For example, if the price of the stock is eight dollars, and I buy a call option with a strike price of 10 dollars, and before the option expires, the price of the stock reaches 12$, I can sell the contract for an increased premium because it leverages the stock 100 shares. If the price does not rise above the strike price before the expiration date, the call option expires worthless making the game very risky. On the other hand, a put option is a short. You are making a bet that the price of the stock will fall below a certain price and you purchase the contract to sell the shares at a higher price, therefore making the difference.

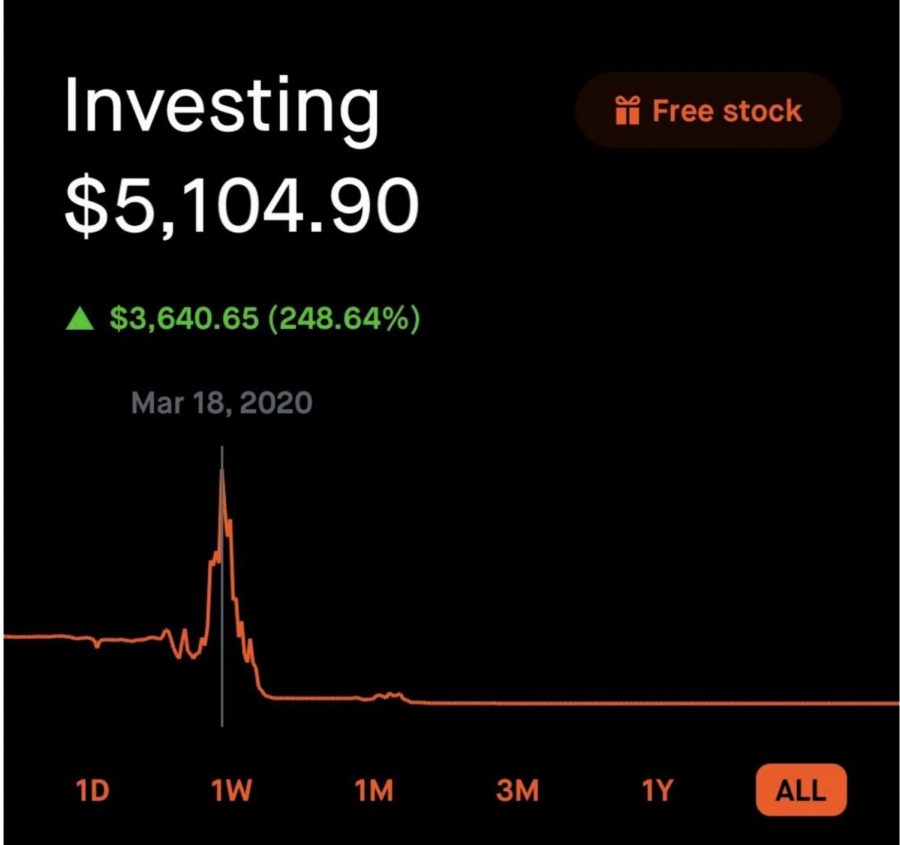

With both the Christmas money and money that I had amassed from working odd jobs, I had amassed nearly 500$. I browsed WallStreetBets for a couple of nights and decided on my next play, I was going to bet on the stock market making a turn for the worst. At the time, Covid cases were growing exponentially and the vaccine timeline was in a very infant stage. In an incredibly lucky bet, I put it all into put option contracts as the economic recovery of the stock market began last April. The bet paid off huge and the 500$ I had turned into over 5,100 dollars. I felt unstoppable. I had figured the game out and was not going to stop any time soon.

With incredible confidence and a seemingly blatant disregard for market patterns, I decided to further short the market. I watched every painstaking market hour as my unfathomable new capital slow dwindled day by day. After a week, I had already lost 400 dollars, after two weeks 4,000 remained. But, I kept steady with the belief that, as Covid got worse, the market would start to falter. But, it never did, after about a month I only had around 1,000 dollars remaining. And within a couple of weeks, three dollars and 80 cents remained in my account, a crushing blow and a reminder of the dangers of options trading.

Over the past month, you have likely heard of the rise of GameStop stock to unprecedented highs. The online Reddit community is “largely responsible” for the price increase, says Deutsche Bank. At one point, GameStop shares were up over 1800%. This was due to what is called a short squeeze. When a heavily shorted stock, around 70% in this case, does not go down and therefore the short positions are filled and the stock supply goes down and the price goes up. The Reddit community was largely responsible for this as the general sentiment of holding the risky positions held steady. Lingo such as “diamond hands” praised those who held through the volatility while using derogatory language to describe the Wall Street investors who used shady tactics to attempt to drive the price down. Even today, the volatility continues as many investors hold onto their stake, large Wall Street firms are now backing down their short positions and many Reddit users are taking in massive gains. One user that goes by the name of DeepFu*****Value turned around 50,000 dollars into 26 million.

Other retail investors were not as lucky as the hype of the stock wore off, the price now hovers at around 100$. However, the overall goal of sticking it to the big Wall Street firms has been achieved as short-sellers lost a reported 26 billion dollars as their short positions expired and they were forced to buy the stock that was deemed worthless to them.

Hi, my name is Leo Bessler and I am a senior at Bellarmine. In school, I enjoy history and the sciences. Outside of school, I am a rower for Commencement...