Do you want to become financially secure? Tori Dunlap B’12 and HerFirst100k have your back

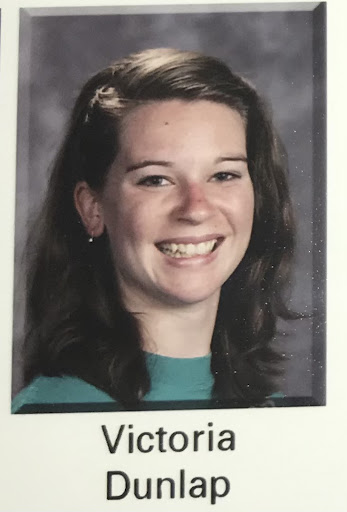

Bellarmine has had many incredible people walk out of their doors and into the world to share their gifts with others, but few have made the impact that Tori Dunlap has made on the world. Dunlap graduated from Bellarmine in 2012 and went on to study marketing at the University of Portland. Dunlap graduated from University of Portland in 2016, from there she began working in the corporate world, running marketing objectives for a Fortune 500 company.

As she came into her own in her career she realized that having a financial foundation offers you choices. Dunlap shared, “Financial stability allows the opportunity to start a business, to donate to causes you believe in, or have kids or not have kids, or get married or not get married or retire early. […] When you have a financial foundation, you have choices, you have agency, and in a world that actively represses women and other marginalized groups from having that agency, having financial security (money) is power.”

This revelation ignited a fierce passion in Dunlap to fight for women’s financial rights and begin her own journey toward attaining financial stability. As Dunlap continued working in the corporate world she saved portions of her salary until she saved $100,000 by age 25. After reaching this point, she quit her job in marketing and founded her company, HerFirst100k. HerFirst100k is a money inquiry platform for women. Dunlap said, “My work is as a money speaker and educator, so I work with women all over the globe, teaching them how to save money, pay off debt, negotiate their salary, start businesses, and start investing.”

Dunlap believes that we don’t have any sort of equality for any marginalized group until we have financial equality. Her focus is “really on fighting the patriarchy by giving women these actual resources to better their money.” HerFirst100k has been wildly successful in helping women achieve their financial goals and create a secure financial foundation for themselves. Dunlap’s hard work and passion has amassed a community of over “three million across all social media platforms. We have 2.1 million on Tik Tok and another 600,000 on Instagram. And then we have one of the top business podcasts in the country called Financial Feminist.”

Dunlap notes that personal finance education has been around for a long time, but what makes HerFirst100k unique that it “looks at financial education as a form of protest in a system and in a society that doesn’t want you to have money and actively gate keeps you from having money and building wealth.” Dunlap believes strongly that female financial security is a form of feminism especially if you are a “multi marginalized [individual]. If you are a queer black woman, society does not want you to have money. And so you know, you becoming financially confident and getting yourself to a point where you’re financially stable enough to then go out and change the systems around you, that is what financial feminism is for me.” Everything that HerFirst100k stands on, hinges from the notion that female financial security is indeed an example of feminism, and that there is no equality until there is financial equality for all.

Last year, Dunlap signed a book deal with Harper Collins and plans to share her wealth of knowledge about personal finance, and continue to inform women across the globe of how to take back their power in the financial world. Financial education is so important, especially for women as Dunlap shared, “99% of domestic violence cases have some sort of financial abuse tied to them. And the number one reason that abuse victims cite for not being able to leave a relationship is money.” Many problems in the world today relate to money: “When we think about the ability to start your own business, you need money in order to do that. When you think about having children you need money in order to do that.” Dunlap said, “When I think about the potential of you know, getting married, I want to get married not because I’m financially dependent on somebody I’m not looking for a man to take care of me financially, right, I can marry or be a partner with somebody out of love and affection for this person as opposed to seeking them for my financial stability. And so, at an individual level, we have all of these things right that that are related to money, and then when we zoom out even further, we realize, you know, all of the the kind of personal finance conversations, unfortunately, are focused on the 10% that is individual, and not the 90% circumstantial.”

As Dunlap has really focused on writing her book she is “peeling back this like onion that is the personal finance conversation and again, realizing systemic oppression is a huge part of this.”

Now, financial education has recently become a course offering at Bellarmine, and as much as Dunlap believes financial education is important, interestingly she doesn’t think that Bellarmine should necessarily require financial education for students. She said, “If I’m being honest, the amount that I actually remember from high school from being 17 is not a ton. So, when I think about teaching something to a hypothetically 16, 17, or 18 year old, who is there to learn academically and then probably dumps that information from their brain as soon as they don’t need that knowledge, I don’t know how effective that is.”

Dunlap does feel however that, “One of the biggest things that needs to be discussed is if you are going to college, the importance of fully understanding what the financial commitment is of that decision.” When you are 17 or 18, “bleary eyed and tired in your sweatpants, you have no idea how this is going to affect your life for potentially decades to come. […] So I feel like the personal finance curriculum is incredibly important. But I think the big two things that are really worth learning more about are student loans and the financial commitment that you’re making as a 17 or 18 year old person going to college.”

A fourth of Bellarmine’s student population is weighing the cost of attending college right now, it’s a stressful and, as Dunlap mentioned, life-altering decision. Bellarmine students should absolutely be educated about student loans as loan offerings vary from subsidized to unsubsidized loans and Pell grants, deciphering between which loan offering is best for you and your family is difficult and students should be supported in that process.

Dunlap and HerFirst100k are making big waves in the financial education sphere and the world at large. Because of HerFirst100k, women across the globe are gaining access to resources and tools to learn how to harness their power. Women are learning to stand up for what they deserve, negotiate their salary, and become financially secure. Dunlap’s mission of fighting the patriarchy and systemic oppression through financial education is inspiring and an incredible step in the right direction towards ensuring financial equality for all.

Kelen Tamurian is a senior this year and is excited to be on the Journalism staff. Kelen is passionate about writing and has published a book called “Simply...